Pay speed is the new loyalty program.

For years, gig platforms have competed on flexibility. But in 2025, the real differentiator isn’t just when drivers work, it’s when they get paid.

In our latest national survey of 419 U.S. gig drivers, one trend stands out loud and clear: drivers follow the money, and they want it fast. A full 70% prefer daily or instant pay, and 85% say fast access to earnings is “very” or “extremely important” when deciding which platform to drive for. That’s not a preference. It’s a dealbreaker.

More than half (57%) said the rate per trip is the #1 factor when choosing a platform that day. But delays in getting paid undercut even decent pay rates. 44% would quit a platform if it tacked on new fees or restrictions to fast payouts — that’s nearly as many as would leave after a pay cut.

Why? Because the financial runway for many drivers is short.

- 65% have borrowed money while waiting to be paid.

- 61% have delayed bills because of payout lags.

- Only 27% say gig driving is a full-time gig but for 59% it’s at least half their income.

That pressure makes same-day pay not just a perk, but a lifeline. And it’s a retention tool with proof behind it: Drivers who get paid instantly report 13 percentage points higher satisfaction than those on weekly cycles.

In a tightening labor market with rising operating costs, the message is clear: The fastest payout wins.

Methodology & sample snapshot

Who we surveyed and why it matters

This report is based on a nationwide survey conducted in May 2025 of 419 U.S.-based gig drivers working on delivery and rideshare platforms like Uber, DoorDash, Shipt, Veho, and others. Our goal: to better understand the priorities, pressures and preferences of the people powering the gig economy.

Who’s behind the wheel?

- Age: Majority were aged 35–44 (56%), followed by 25–34 (27%), and 45–54 (16%).

- Gender: 64% identified as male, 36% as female or non-binary.

- Income: 57% live in households earning under $75K annually. Just 12% reported household income above $100K.

- Location: Drivers were spread across regions:

- West: 28%

- South: 26%

- Midwest: 24%

- Northeast: 22%

- West: 28%

This group reflects the broad reality of gig drivers today: diverse in background and highly reliant on driving as a key source of income. Importantly, their insights shed light on what drives platform loyalty, what pushes them away, and where platforms have room to improve.

The multi-app reality

Number of apps used on a monthly basis

In the world of gig driving, loyalty takes a back seat to pragmatism.

If you’re assuming your drivers are exclusive to your platform, think again. Nearly 7 in 10 (68%) work across two or more gig apps each month. Only 32% stick to one.

Drivers go where the earnings are best, the payouts are fastest, and the experience is smoothest. Loyalty is conditional — and often short-lived.

Why drivers leave

When we asked what would make them stop using a platform, here’s what they said:

- Sudden drop in pay rates or bonuses — 59%

- Fewer available jobs — 48%

- New fees or restrictions on instant/daily payouts — 44%

- Safety concerns (unsafe pickup/drop-off situations) — 41%

- Rigid scheduling that cuts flexibility — 39%

The takeaway? It’s not just about total earnings. Drivers are constantly evaluating friction, whether it’s longer waits for payouts, changes in policies, or a shift in flexibility.

When 44% say they’d walk if instant pay becomes slower or more expensive, it’s not just a preference. It’s a business decision.

Why this matters to platform leaders

Multi-apping has raised the bar. You’re no longer just competing on pay rates or app features. You’re competing on how easy and fast you make it for drivers to earn and to access those earnings.

Your best drivers might already be testing out your competitor’s app, and all it takes is a small slip in experience to make them switch.

Economic pressures & cash-flow strain

When paychecks are delayed, bills can’t be

Gig work promises freedom. But for many drivers, that freedom comes with a financial edge. Behind the wheel, there’s often a sense of urgency not just to earn, but to survive.

59% of drivers rely on gig work for at least half their income.

- 27% say it’s their primary income source

- 32% earn about half from it

- 41% use it to supplement other income

This isn’t just a side hustle. For most, it’s essential to paying rent, buying groceries, and keeping the lights on.

Why speed matters

Waiting to get paid can have real consequences:

- 65% have taken a payday loan or cash advance because payouts lagged

- 61% have delayed a bill or essential purchase while waiting for earnings

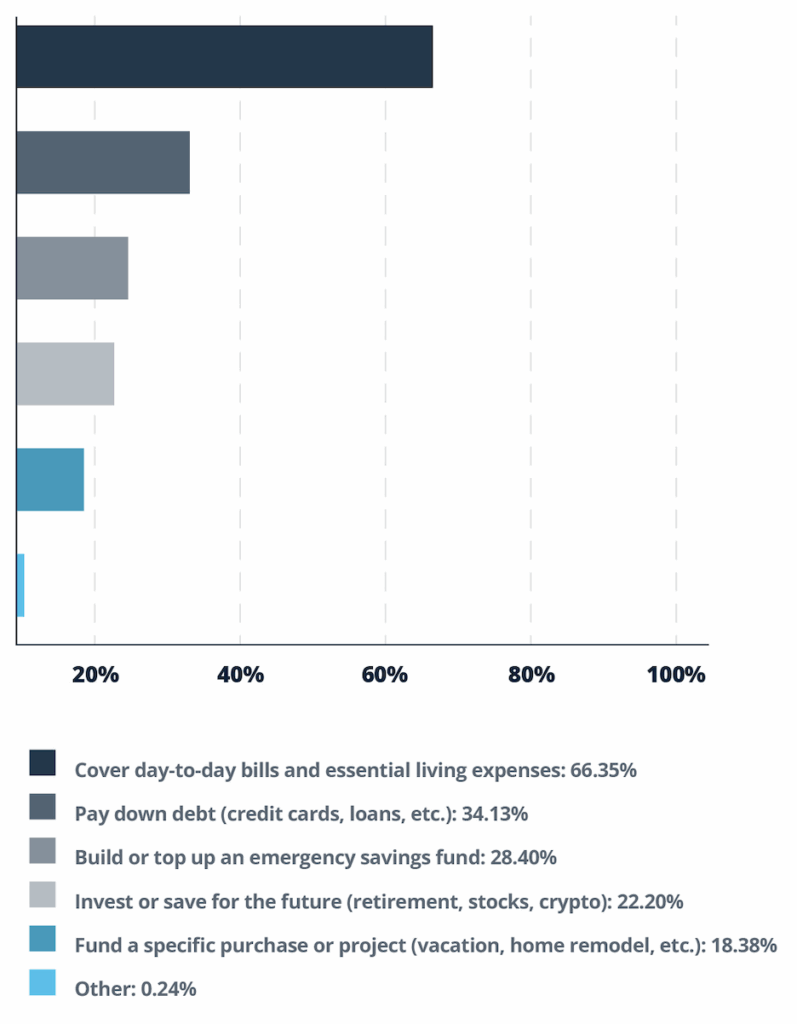

- 66% say their main reason for driving is to cover day-to-day bills

- A third are paying down debt

- Only 28% are building any form of emergency savings

This isn’t about extra cash for spending — it’s about making ends meet. When income is irregular, even a few days’ delay can trigger late fees, overdraft charges, or borrowing costs.

How drivers spend their gig earnings

Not just about pay but about cash flow

Offering competitive rates per trip is only part of the equation. Without fast access to earnings, the value diminishes. Drivers are often forced to borrow, sometimes from expensive sources, just to float a few days.

Platforms that can smooth that cash flow not only show respect, they also reduce churn. Because no one wants to stay on a platform that adds financial stress to an already stressful situation.

Fast pay = driver retention

When drivers choose between platforms, it’s not always about who pays more

It’s often about who pays first.

84% of drivers say fast access to earnings is important or very important when deciding which platform to work for. That puts payout speed in the same tier of importance as base pay and job availability.

Here is how frequently drivers are paid today vs. what they want:

| Preferred Payout Cadence |

| Instant or daily – 70% |

| 2–3 times per week – 16% |

| Weekly – 12% |

The preference is clear: 7 in 10 drivers want their money within 24 hours.

Daily pay or per-trip earnings let them cover bills, buy gas, or decide whether to log extra hours that day.

Additionally, 84% of drivers say fast access to earnings is important or very important when deciding which platform to work for. That puts payout speed in the same tier of importance as base pay and job availability.

What happens when payout speed drops?

- 44% would consider quitting if instant pay got slower or more expensive

- That’s just behind pay cuts (59%) and job scarcity (48%) as top reasons for leaving

- Satisfaction is 13 percentage points higher for drivers who get paid instantly vs. those on weekly cycles (63% vs. 50%)

Fast pay isn’t a “nice to have,” it’s a competitive edge. And when platforms put limits, fees or delays on that experience, drivers notice. Worse, they leave.

Pay speed predicts churn risk

Drivers are already multi-apping. All it takes is a single policy update, a new fee, or a processing delay to push them toward a competitor. In other words, slow pay is a silent churn engine.

And unlike raising base pay or handing out bonuses, speeding up payouts is a change that doesn’t inflate per-trip costs.

Job satisfaction for drivers paid instantly vs. weekly

The onboarding edge

Speed to first dollar is the hidden growth lever

In the race to grow driver supply, most platforms focus on referral bonuses, advertising, or driver incentives. But one area often gets overlooked: onboarding speed.

For gig workers, time is literally money. The longer it takes to start earning, the more likely they are to lose interest — or switch to a competitor that lets them hit the road faster.

- 21% of drivers say they would walk away from a platform if the onboarding process takes too long

- Slow onboarding doesn’t just delay activation — it increases acquisition costs, inflates drop-off rates, and weakens first impressions

- In contrast, platforms that enable drivers to sign up and start earning within hours get a measurable edge in supply growth

It’s not just about speed. It’s about momentum.

Gig work can be impulsive. A driver might decide today they want to start earning. If they can’t get rolling quickly, that momentum is lost. Worse, it’s redirected somewhere else.

By removing friction in the first 24 hours, especially around paperwork, background checks, and first payouts, platforms can increase activation rates and reduce early churn.

And when the first payout lands quickly, drivers are far more likely to keep driving. It creates a positive feedback loop that reinforces loyalty right from the start.

The takeaway

First impressions matter. And for many drivers, your first impression is your onboarding flow. Streamlining that process is one of the most cost-effective ways to grow and retain your workforce.

Beyond the wheel: Side hustles & economic uncertainty

For many drivers, gig work is part of a bigger financial puzzle

While driving may be the main focus, most gig workers don’t rely on a single income stream. They’re stacking side hustles out of necessity.

58% of drivers say they layer at least one other income stream on top of their driving work. This could be reselling, renting out property, completing online surveys or taking on other freelance gigs. They’re building patchwork paychecks to stay afloat.

But for nearly half, driving is the backup plan

Despite this hustle, 42% rely solely on driving for supplemental cash. And for 59%, gig earnings make up at least half of their total income. That’s not play money — that’s rent, groceries and fuel in the tank.

How drivers plan to navigate 2025

When conditions get tougher, drivers plan to drive more — not less.

In a shaky economy, gig work becomes a safety net. When costs rise or income sources disappear, drivers don’t walk away. 54% say they’d increase their driving hours if economic conditions worsen in 2025. That tells us something important: gig platforms aren’t just side hustles anymore, they’re fallback plans.

But driving more only helps if it pays off fast. When drivers need to fill financial gaps quickly, delays in payouts create extra strain. Whether it’s covering a surprise expense, topping up on fuel, or avoiding late fees, access to earnings can make the difference between staying on the road and burning out.

Payout speed is a survival tool

Drivers may not control market conditions, but they can choose where they work. And when every dollar counts, platforms that release earnings sooner feel less risky and more useful.

Fast payouts help drivers adapt without added stress. In uncertain times, speed isn’t just a perk — it’s a form of financial stability.

Recommendations for gig platforms

If you want to keep drivers, here’s what to do next

The data’s clear: drivers are financially stretched, operationally flexible, and increasingly selective. Loyalty is earned through real-world improvements, not app updates or slogans. Here’s how to build a platform that drivers stick with and advocate for.

1. Offer instant pay

This is your churn-reduction lever. Drivers who get paid quickly are more satisfied and less likely to leave. If possible, make instant pay free or limit the amount of fees your drivers pay to cut churn risk. With modern payroll tech, it’s easier than ever to deliver this without overhauling your system.

2. Streamline onboarding

If drivers can’t start earning within a day, many won’t wait around. Compress the time from signup to first payout. Treat onboarding like a product funnel, and every delay is a leak.

3. Be transparent about pay

Drivers don’t just want more, they want clarity. Show how pay is calculated. Break down commissions, bonuses and tips clearly. When drivers understand their earnings, trust goes up, and complaints go down.

4. Leverage flexible pay tech

Don’t patch your existing payroll with band-aids. Use platforms like Everee that are built to support same-day pay for both 1099 contractors and W-2 employees. It’s fast, compliant, and scalable.

About Everee

Payroll built for the pace of gig work

Everee is a modern payroll platform designed for flexible workforces. Whether you’re paying 1099 drivers, W-2 employees, or both, Everee gives you the ability to offer same-day payouts without rebuilding your payroll infrastructure.

We built Everee to solve the exact problems surfaced in this report: delayed earnings, driver churn, onboarding friction, and pay transparency. With Everee, gig platforms can move faster, pay faster, and build stronger loyalty with the people powering their business.To learn how Everee can help your platform retain more drivers and streamline your operations, schedule a demo today.

Get your full copy of the report here: