The gap is narrowing between staffing success and failure.

By 2030, the global temporary staffing market is expected to eclipse $130 billion, up from $90 billion in 2021.

As organizations rely on more and more contingent workers both 1099 (gig workers) and W2s who work on a temporary or on-demand basis — the payroll landscape is evolving to support them. In addition to mounting regulatory pressures around worker classification, tech-enabled platforms have emerged to address temporary staffing payroll needs, meeting workers where they are with modern, fintech-powered solutions with rapid payouts.

Take healthcare staffing, for example. According to Everee’s 2024 Healthcare Staffing Report, 66% of healthcare workers live paycheck to paycheck. That being the case, it comes as no surprise that 80% of healthcare professionals want faster pay to the point that 68% of them would choose a job that paid them within 24 hours over one that didn’t.

In the age of Uber and DoorDash, workers have grown to expect instant payouts. Believe it or not, some healthcare staffing companies lose nurses to companies like Amazon because they pay faster.

In other words, staffing companies aren’t just competing with each other and against full-time roles. They’re also competing against other ways to earn a living.

To win the war for talent, temporary staffing agencies must embrace faster payouts with solutions that don’t create more operational burden. Otherwise, it’ll get harder and harder to operate and turn a profit as workers flee to companies that are more forward-thinking with payroll.

This guide examines the current state of payroll for temporary and on-demand staffing companies, along with the reasons why you need specialized payroll solutions to prepare for the future.

The staffing tech stack: Rethinking payroll

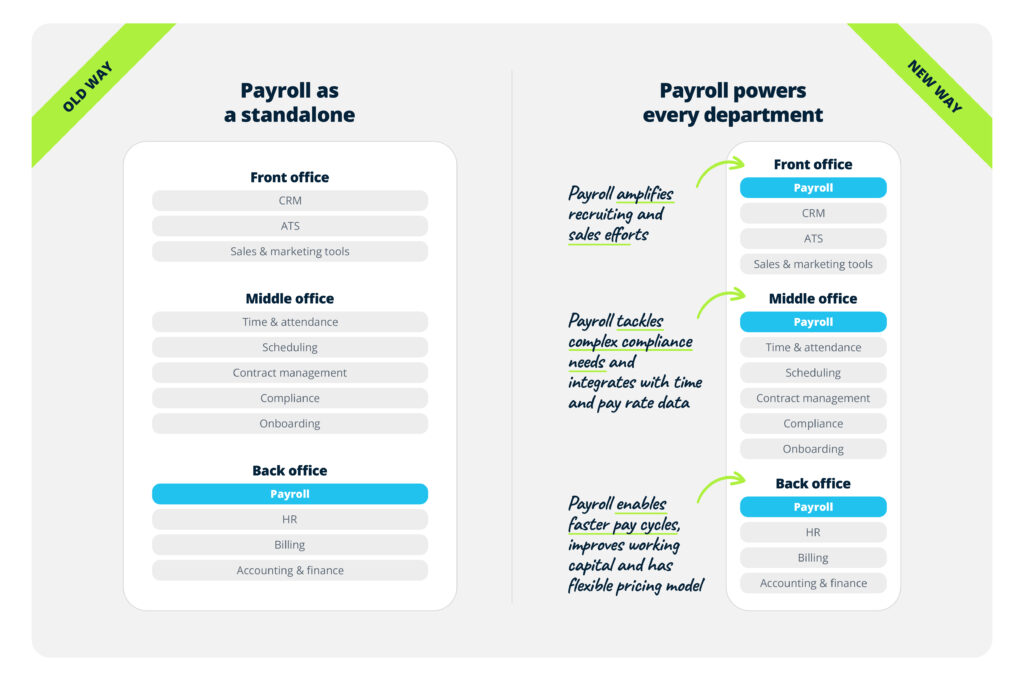

A staffing firm’s tech stack plays a central role in improving operational efficiency but forward-thinking leaders see its potential beyond that.

Divided into three essential areas – front office, middle office, and back office – this technology framework shapes your operations, from initial client interaction to candidate placement to billing. Each area has its own set of tools and tricks, but there’s one crucial piece often overlooked in the mix: payroll software.

The payroll provider you choose is as central to your candidate experience as your ATS. Let’s dive into why you can’t afford to sideline payroll as just another standalone technology, but rather integrate it tightly across your entire office stack.

Front office

The face of your staffing firm, the front office is where client relationships are built, and candidates are sourced and engaged. Customer Relationship Management (CRM) systems, Applicant Tracking Systems (ATS), and sales and marketing tools are the mainstay here. These tools enable seamless communication with clients and candidates, efficient tracking of leads, and strategic marketing campaigns.

You might be wondering how payroll fits in here. Historically, it hasn’t. But if you choose payroll software that allows workers to get paid quickly after a shift, the story changes. Paying faster than the competition becomes a compelling narrative to entice both clients and candidates. When you can offer same-day or instant payments to candidates, it’s a powerful testament to your commitment to worker satisfaction and financial well-being. You’ll hire more talent and gain the attention of clients that want to align themselves with a staffing firm that puts workers first.

Middle office

The operational hub of staffing firms, the middle office encompasses time and attendance tracking, contract management, scheduling, compliance, and onboarding processes. Here lies the nexus between candidate acquisition and client fulfillment. Effective middle office technologies streamline workflows, ensure regulatory compliance, and enhance candidate experience.

However, without seamless integration with payroll software, these processes can become fragmented and inefficient. This is why you need to think about how payroll interacts with the middle office software, including integrations with time and rate data and streamlining the onboarding process. Moreover, compliance becomes more manageable when payroll systems handle the intricacies of pay-related regulations (like tax and overtime calculations) alongside other middle office operations.

Back office

The backbone of administrative operations, the back office encompasses payroll, billing, accounting, and HR functions. Payroll software within the back office ensures accurate and timely payment processing, handles labor compliance, and manages employee data.

Those functions are table stakes for payroll. This guide explores how payroll purpose-built for staffing goes beyond these standard requirements to deliver innovations that give your firm a competitive edge in multiple areas.

The state of payroll for staffing: What’s not working

Payroll can only play a strategic role throughout your organization if you choose the right software. The status quo solutions may check some boxes but they aren’t game-changers.

In this section, we examine the current landscape of payroll solutions, including legacy software, earned wage access (EWA) and pay cards, and payroll and payment API companies, and uncover why these solutions often fail to meet the needs of staffing companies.

Legacy payroll software

Legacy payroll software has remained largely stagnant since its inception. While it once served as the cornerstone of payroll management for staffing companies, its failure to adapt to evolving industry needs has left many organizations grappling with outdated systems and cumbersome processes.

Limited flexibility with time tracking, corrections and pay rates

For starters, staffing companies have complex time tracking needs. You likely require timesheet verification and approval from the back office of your agency, as well as your client. Traditional payroll solutions have one-size-fits-all time tools and don’t integrate well with timesheet software built for staffing. With these solutions falling short, it’s all too common to collect time data on paper with a copy sent via email or text.

Payroll software built for staffing plays nice with your existing time tracking process. No matter what time tools you use– whether proprietary to you or a third-party’s–it offers easy ways to ingest time data, for instance in bulk upload format via a spreadsheet, or APIs to automate the transfer of time data from one system to the other. It may also integrate with third-party time and scheduling tools that specialize in staffing.

Another process that’s more critical for staffing firms than other businesses is making time and pay corrections. Payroll tools purpose-built for staffing make handling corrections a breeze, allowing you to quickly fix over- and under-payments and adjust taxes accordingly.

Lastly, most legacy payroll providers have tools for shift differentials but can’t account for multiple pay rates during a single pay period. That’s because they built their pay rate tools for part-time and salaried employees, not contingent staff. Staffing payroll makes it easy for you to drill down to the particular shift and set a rate for it.

Archaic pay cycles

Most payroll software offers weekly pay as the fastest pay cycle. Even then, workers are getting paid for work they completed the previous week.

This might look like the above graphic. In this illustration, a worker takes shifts Monday-Wednesday and completes their timesheet for those shifts on Friday. The following Monday, the payroll administrator begins the process and runs payroll on Wednesday. The worker gets paid that Friday—a full week after they completed their timecard.

This experience is less than ideal for workers. It creates anxieties around whether or not their timesheets are received and processed correctly, which inevitably leads to a large volume of “where’s my money?” calls or emails into your back-office staff. The delay in reward for a hard week’s work can disincentivize people to pick up more shifts for your company.

Payroll software built for staffing removes this delay entirely, with the ability for pay to be processed and deposited into workers’ accounts on the same day. These solutions may also offer alternative deposit methods, like a pay card, that allow for payouts on weekends, evenings and holidays.

That means the worker could get paid on Friday for shifts worked that week. When payroll is built for speed, companies can pay workers as fast as they can verify hours, creating a competitive advantage for hiring and retaining talent to improve fill rates.

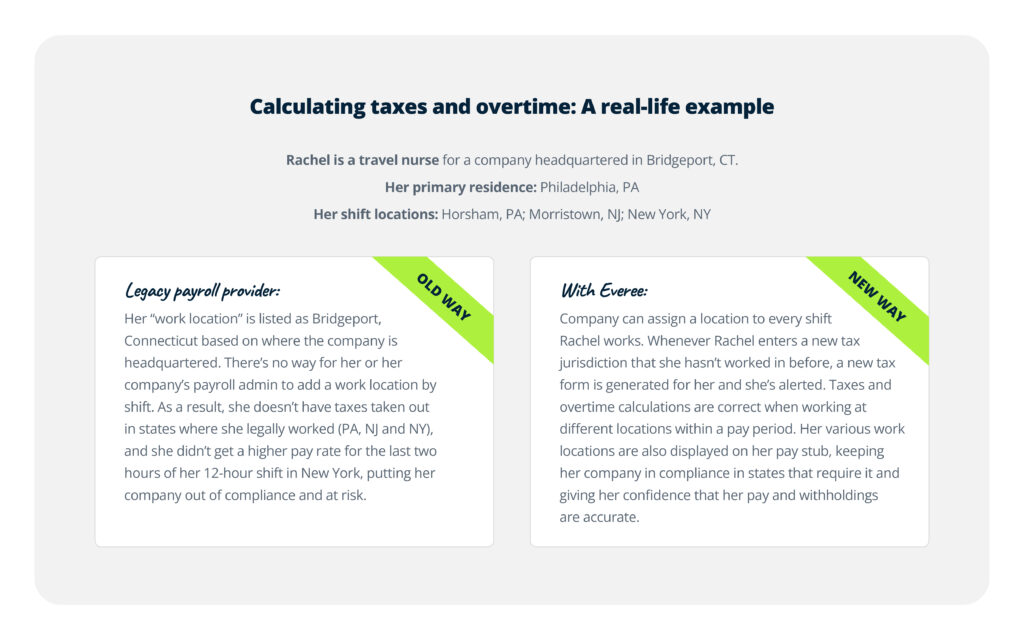

Tax and overtime calculations don’t account for multiple work locations

The default rule for state income tax withholding is to deduct taxes for the state where the work is done. Almost every state expects employers to deduct taxes from the wages of employees who work within their borders, even if those employees don’t live there or if the employer isn’t based there. This can present a challenge for staffing companies that deploy workers across multiple states and tax jurisdictions.

Legacy payroll software hasn’t accounted for staffing use cases. For instance, say you own a healthcare staffing agency that’s headquartered in Connecticut. You have a nurse who lives in Philadelphia and picks up per diem shifts in Pennsylvania and New Jersey within the same pay period. Most payroll software would default to taking out state and local taxes based on the agency’s location, in this case Connecticut, because that’s what would appear on the nurse’s profile as the “work address.”

Payroll built for staffing accounts for the flexibility your agency needs when it comes to deploying workers across multiple locations. It allows you to set a location for each shift–ensuring your tax filings are accurate and you stay compliant.

The same goes for overtime rules. While there are federally mandated overtime rules based on the Fair Labor Standards Act (FLSA), individual states may have their own labor laws. These state laws can vary significantly in terms of eligibility criteria, overtime rates, and other regulations. For example, some states have lower thresholds for overtime eligibility (e.g., requiring overtime pay when over eight hours are worked in a day rather than 40 in a week).

Overtime calculations get complicated when you have a temporary worker taking shifts in multiple states. In the previous scenario, let’s say the nurse takes a shift in New York as well. New York has a “spread of hours” provision, which requires additional pay for non-exempt employees who work more than 10 hours in a day (including time off-duty like breaks and lunches), regardless of the total hours worked in the workweek.

It’s important to look for payroll providers that have accounted for these use cases. If not, your agency could face various consequences, including lawsuits by employees and fines or penalties imposed by the state.

Inflexible pricing model and no option for payroll finance

Legacy payroll software charges on a per-worker basis. That’s fine when you have a set number of people who work in any given month, but that’s not how staffing firms operate. This is cost-prohibitive for staffing agencies because you’re stuck paying for workers who are inactive at any given point in time.

If you don’t want to be billed for these workers, you might be forced to “separate” them, so they are no longer active in your payroll tool, even though they might take a shift the very next month. This is a ridiculous administrative hassle just because a payroll company hasn’t adapted their pricing model for staffing firms.

On the flip side, staffing payroll is priced to meet the unique needs of the industry. Your payroll company would only bill you for workers that are actively paid within a month, or you could choose to pay by the transaction instead of the worker count. By the transaction means you pay a small fee for each payment sent vs. a set amount per worker–a true only-pay-for-what-you- use model.

Another financial shortcoming of traditional payroll providers is that they don’t account for working capital struggles in staffing. When clients have negotiated extended payment terms of 30 or 45 days (or sometimes longer!), it can feel impossible to have enough cash to cover payroll.

There’s no shortage of factoring services that support staffing companies, but payroll providers that specialize in staffing may offer their own payroll finance solutions, like Everee Credit. In this case, the payroll company fronts payouts to workers on their own credit line and you pay them back on the agreed upon repayment schedule, usually for a percentage fee.

Earned wage access apps and pay cards

As dissatisfaction with traditional payroll systems and slow pay cycles has escalated in recent years, a slew of earned wage access (EWA) apps and instant pay cards have emerged. While these solutions may seem like a breath of fresh air, these quick-fix remedies fail to address the root cause of the problem: outdated payroll infrastructure.

To give workers the option to get paid faster, some staffing companies offer EWA apps, which enable workers to access a portion of their earnings ahead of payday.

Operationally, these can be simple to execute if they’re integrated with your payroll software. Since payments made through these apps are essentially loans to workers — not the company — EWA apps don’t create additional cash flow issues for organizations.

While these solutions can help workers get paid faster, they don’t provide workers with true daily pay — something that 75% of all workers want. Workers can only access a portion of their earnings early as long as they proactively request it — and are willing to pay a fee if the EWA provider levies one. And really, who wants to pay to get money they’ve rightfully earned through their hard work?

On top of this, if the EWA solution isn’t integrated with your payroll system, it’s yet another tool for your back office to manage.

When staffing agencies are losing people to gig economy companies, EWA isn’t enough to keep workers happy. Uber, DoorDash and other gig giants have created the expectation that workers should get paid their full earnings as soon as a shift or job is complete. The same can be done in temporary and on-demand staffing with the right payroll provider, ensuring you’ll never again lose candidates because you pay too slowly.

Like with EWA, instant pay cards are often from a separate vendor, which means workers have yet another app they have to download and manage. It can also put an unnecessary burden on your administrative team to deal with an additional relationship and process.

Most of the time, pay cards are free to employers and, in some cases, offer the ability for workers to get paid instantly. These products don’t give workers the flexibility on how they’re paid, though–workers still have to wait for their funds (usually for 2-3 business days) if they need money in their bank accounts (e.g., to pay rent).

What’s more, pay cards aren’t legally compliant for W-2 workers–companies must provide W-2s with options on how to get paid, including direct deposit.

Bottom line: Pay cards can be a valuable tool for getting your people paid faster, but only if it’s not the only option they have.

Staffing payroll offers flexible payment options to match the flexible workforces it serves. This means it gives workers the ability to choose where they want to receive their funds, and it’s a core part of the payroll infrastructure, allowing workers to receive all of their earnings as fast as possible without the headache of reconciling on a traditional pay cycle.

Payroll and payment API companies

You can’t look at the landscape of payroll for staffing without talking about solutions for staffing platforms. Traditional staffing models are being increasingly replaced or augmented with platforms. Staffing Industry Analysts’ 2024 Temporary Staffing Platform Update notes that 12 of the top 15 staffing firms now have platforms, up from four just five years ago. The update states that nearly a quarter of firms plan to implement a platform model in the next two years.

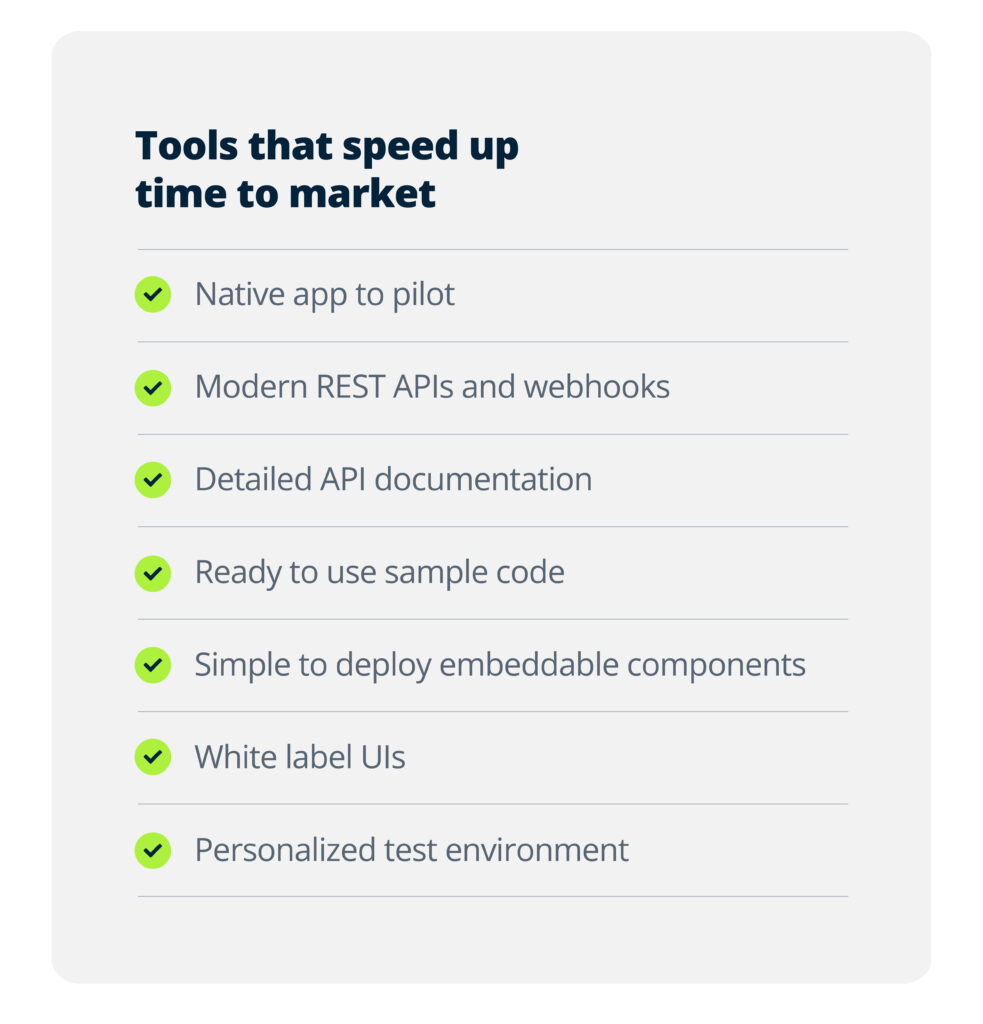

Whether you plan to build a platform, buy out-of-the-box software or keep a self-service model but automate certain tasks, there’s a role for technology to play in any staffing company. Payroll technology presents a key piece of the puzzle–but the options vary greatly in terms of resource investment.

In recent years, several “payroll API” companies have emerged with promises to solve payroll problems by letting you custom-build solutions to meet your needs.

While these tools offer flexibility and can integrate with existing systems — you can build pretty much whatever you want with them — they require a lot of pricey development work. It’s not uncommon to run into challenges related to data mapping, compatibility issues, and system configuration, for example.

These solutions also aren’t built with full-service payroll capabilities. Organizations that build with these solutions often end up with massive overhead costs, like having to hire a tax team to calculate, file and remit taxes internally.

There’s also no way to ease into testing if these solutions will work for your business. They take an all-or-nothing approach since there’s no native app experience to test drive.

Payment API companies are similar but because they don’t have traditional payroll features like a tax engine, garnishment support, labor law compliance, PTO reporting and more–they aren’t even an option if you have W-2 temporary workers.

Mitigate risk and simplify development work with the right technology solutions

What staffing firms really need is full-service payroll with prebuilt dev tools. This gives you the flexibility to integrate payroll into your technology without building it from scratch.

For example, here’s what this would look like with Everee. If you have an app that already includes staff onboarding, shift scheduling, assignments and timesheets, you can use Everee’s flexible APIs to automatically calculate payments from this data to remove manual, error-prone work. You can also embed Everee’s UIs, like pay stubs and tax documents, within your own app so workers never have to leave your experience.

Unlike payroll API companies, Everee has a native app, which means you can run a pilot or test drive a sandbox experience with zero dev work. This removes risk from your evaluation process, giving you the chance to learn more about the software without sinking lots of time and money into a project.

Why you need payroll for staffing, not payroll for “anyone”

Payroll for staffing companies requires a nuanced approach.

Solutions like Everee elevate payroll from the back office to being a strategic lever for the front and middle office, too.

It harnesses the compliance expertise of legacy payroll companies, ensures swift worker payouts akin to earned wage access, and offers the flexibility facilitated by payroll APIs—yet sidesteps the shortcomings inherent in each.

Here are the key differences with payroll built for staffing:

- Compatible with your existing time and scheduling tools, that creates a single source of truth, increases data integrity, and frees employees from having to manually copy data from one system to the next.

- Ease of use, with the ability to easily make corrections for over- and under-payments and adjust taxes.

- Compliance tools that enable you to have accurate tax filings, overtime calculations and pay stubs when workers take shifts in multiple jurisdictions or states.

- Ability to handle multiple shift rates even within the same pay period.

- New hire onboarding automation to streamline tedious tasks and give employees more time to focus on important initiatives.

- Pay flexibility, which gives workers the option to receive money via direct deposit or by pay card if they want their funds even faster than direct deposit.

- Support for faster pay cycles, as often as daily, for both 1099 and W-2 workers, with the ability to get paid on evenings, weekends and holidays.

- Per-payment or active worker pricing instead of charging for all workers, which enables staffing companies to maintain many temp workers in their systems while only paying for people who worked that month.

- Simple dev tools that allow you to embed the payroll experience in your own app or create custom integrations without a lot of work, plus a native app to pilot before committing to a development project.

- Payroll finance to help you manage cash flow when your clients are on longer repayment schedules.

When it comes to payroll, temporary staffing companies face unique challenges compared to other companies that rely on a permanent workforce. By adopting a payroll solution built specifically for staffing companies, agencies can rest comfortably knowing their complex needs are taken care of.

Make payroll your staffing superpower with Everee

Staffing agencies have a lot to juggle with payroll.

Not only is it difficult to stay on top of timesheets, you also have to manage variable pay rates, ensure workers are classified accurately, and comply with labor and tax laws. It’s a tall order any way you slice it — one that’s much more difficult without the right tools in place.

Everee is payroll software purpose-built for staffing companies.

By investing in Everee, companies like yours can solve these challenges while also improving recruiting efforts and fill rates by giving workers the critical benefit of faster pay.

As the only full-service payroll solution that offers same-day payouts to both W-2 and 1099 workers, Everee makes it easy to deal with the complexities inherent in paying contingent staff while staying compliant.

We offer a unique pricing structure where you only pay for what you use and aren’t charged for every staff member you have in our system.

Designed with flexibility top of mind, Everee enables payroll teams to quickly upload timesheet data from any system or integrate via APIs. You can manage variable shift rates with ease, and our corrections tools make it simple to reconcile inaccuracies and adjust pay and taxes accordingly.

Our proprietary compliance calculator is built for flexible work locations, ensuring taxes and overtime are calculated at the shift-location level instead of an employee’s default work or home address.

Together, this functionality makes it much easier and faster to process payroll and ensure accurate payouts — every time.

We also offer built-in payroll finance via Everee Credit to help you manage cash flow when you’re dealing with extended client payment terms.

As more and more workers get accustomed to faster pay, staffing companies that are slower to embrace the future of payroll will have a hard time attracting and retaining talent.

By making the move to Everee, you can position your business to win the war for talent while keeping your team happy and engaged and ensuring your clients are delighted. It’s an easy way to transform your business, impress your workers, and increase your margins.

Not happy with your generic payroll solution? Let’s talk.