For many workers, waiting 2 weeks or more to get their paychecks leaves them in a bind. Growing credit card balances, overdraft fees and payday loans become critical to make end’s meet.

To fill the gap between bills being due and paychecks hitting the bank account, new financial alternatives have popped up to ease cash flow problems for workers. Tools like Buy Now, Pay Later (BNPL), overdraft protection products, and earned wage access (EWA) apps are gaining momentum, as well as scrutiny.

Earned wage access can be an attractive benefit for workers who are comparing potential employers who don’t have on-demand pay options. Companies like Wal-Mart offer earned wage access tools to their employees in a suite of benefits aimed at enticing applicants and retaining them in a worker shortage.

But earned wage access is not without its problems. Regulatory scrutiny, fees and privacy concerns surround earned wage access providers. This article will dive into how earned wage access works and what employers need to know before offering earned wage access to their employees.

What is earned wage access?

Earned wage access is a way for employees to receive a portion of their earned wages before their regular paychecks. The majority of EWA solutions rely on mobile apps that are easily accessible to most workers. Earned wage access apps are sometimes called early wage access, paycheck advance or cash advance apps, because they offer a small portion of a forthcoming paycheck for a fee. Thus far, regulators haven’t categorized earned wage access as a payday loan, because workers aren’t charged interest on the money they receive ahead of their paycheck. But EWA apps have received strong accusations of payday loan-like operations by consumer advocacy groups.

How does earned wage access work?

Earned wage access apps give employees some portion of their earned wages after they’ve worked a certain number of hours in a pay period. To gain access to funds, workers must connect their bank account to the earned wage access app. Depending on the type of app used, workers must also upload their timesheets or connect to their employer’s time clock software.

Once the earned wage access app verifies that the worker has completed a minimum amount of hours worked, users can request an advance on their paycheck. The advance usually has a limit between $100-$500. When the pay period ends, the app deposits the remaining wages on the set payday.

Is earned wage access a loan?

In many cases, the funds are provided directly by the earned wage access company for a fee, which is why many categorize earned wage access as a personal—or payday-like—loan. The National Consumer Law Center argues EWA services operate the same as a loan provider: “Unpaid wages are merely an asset securing a payday advance, just as another lender might secure a loan with a car…[a]ssessing the hours the borrower has worked since the last paycheck is merely a form of underwriting.”

How do earned wage access apps make money?

Technically, earned wage apps aren’t considered payday loans and are marketed as a more financially responsible payday loan alternative. In contrast to payday loans, which typically charge high interest rates on loan amounts (in addition to a flurry of administrative fees), earned wage access apps usually charge workers in one or more of the following ways:

- A monthly membership fee

- Instant access or same-day deposit fee

- Fee per withdrawal (Some EWA apps equate this to an ATM fee)

- Fee per bank transfer

- And/or an optional “tip” after each transaction

The tipping structure used by many earned wage access apps may function more like high interest rates than workers initially realize. A $2 tip on a $20 paycheck advance over 14 days is equal to a 260% APR—the same average interest rate you’d be charged for a payday loan in Wyoming or Rhode Island—as shown in this Nerdwallet review of earned wage access app Earnin.

Employer partnerships with earned wage access apps

Some earned wage access companies offer partnership opportunities directly to businesses. Companies can offer an optional earned wage access benefit to workers at no cost to the organization. The company and the EWA app work together to ensure that employees meet the eligibility requirements, and then the app manages deposits. Using integrations with an employer’s payroll and time management systems, earned wage access apps confirm hours worked before making an advance.

EWA apps often offer adjacent features like budgeting tools, so employers position the perk as a financial wellness program to their workforce. These partnerships are particularly popular among companies with large hourly workforces, like retail companies and restaurants, and organizations in the gig economy with an incentive to motivate gig workers.

Earned wage access apps for consumers

Workers can directly access earned wage access apps without a partnership via their employer. If a worker meets eligibility requirements like having a bank account and a set payday, they’re able to sign up for earned wage access apps that offer a direct-to-consumer model. Workers must prove they’re eligible for wages by uploading proof of hours worked. All the same fees apply.

Benefits of earned wage access

The earned wage access industry has exploded in popularity over the past 5 years. Workers requested ~56 million payback advances worth almost $10 billion in 2020. Last year’s figure was up dramatically from 2018, when there were only ~19 million advances worth around $3 billion, according to a study.

Earned wage access has offered some workers financial reprieve; there are benefits for workers when used responsibly. Earned wage access can offer financial security when an unexpected expense under $500 comes up.

For employers, earned wage access can attract workers and retain them. According to a survey by PWC, EWA boosts employee retention by approximately 36%.

Risks of earned wage access

While some believe EWA programs to be a boon for cash-strapped workers, there are drawbacks worth exploring. These risks should be considered by employees and employers before implementing earned wage access, especially as it compares to other fast pay options and financial wellness programs.

Hidden profit models can exploit workers

As mentioned earlier, earned wage access companies charge workers in a variety of ways, but those fees are not always clear to users. While membership and transfer fees may be transparent, the tipping feature can often lead to workers unknowingly paying high rates on advances.

Maximum advance limits aren’t enough for expenses

Some workers are disappointed to discover limits on their advances. These maximums are designed to limit exposure for earned wage access apps who do the lending, but for workers who have an immediate need for funds, the limits can be frustrating.

Some EWA apps promote advances up to $500, only for workers to discover that new users are only allowed advances of up to $100 until a certain amount of time has passed. Other apps restrict the amount of times a worker can request wages in a single pay period, sometimes leaving them without the cash they need.

Some advocacy groups believe EWA apps are loans

EWA apps are under an enormous amount of scrutiny by consumer advocacy groups, who argue to regulatory bodies that EWA providers should be classified as payday loans. The Consumer Financial Protection Bureau (CFPB) has also made it clear it’s revisiting an earlier advisory opinion stating EWA apps are not loans. Various states have attempted to draft laws providing safe harbors to EWA apps, but many are waiting before acting due to the evolving nature of the technology. How EWA apps are allowed to operate will most likely vary state-by-state.

EWA isn’t available on-demand or when it’s truly needed

After a wage request, workers can often experience long wait times before they receive their advance. In some cases, there’s a mandatory one- or two-day waiting period between when the worker submits time worked and when they’re able to access those wages.

Earned wage access apps often promote real-time payments, but instant wage access isn’t available across all tools. Some EWA apps offer instant access to wages at an additional one-time cost. Other apps require users to upgrade to a more expensive membership in order to access instant pay features.

Cyclical borrowing doesn’t promote financial wellness

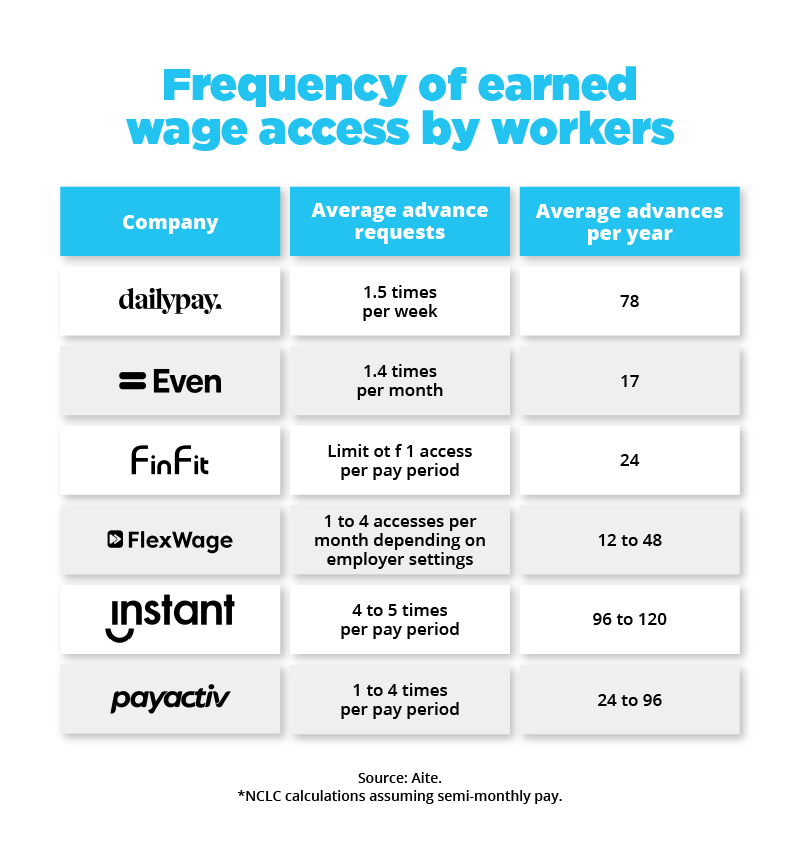

What may be seen as a one-time emergency option actually becomes a financial lifeline that doesn’t permanently improve the financial wellness of workers. A 2019 study showed that most workers take advances multiple times a month, including one or more every pay period.

Due to compounding fees, continuous borrowing can quickly become unmanageable, and may actually leave workers in a worse financial position than they were before.

EWA apps require sensitive financial information

When consumers sign up for EWA apps, they must provide sensitive personal and financial information in order to get paid. Of course, these apps offer security guarantees, but any sharing of personal information online comes with a risk. This data can be breached or mishandled, putting workers at risk for further financial harm.

Privacy concerns are rampant

Some pay advance apps are working with data research companies to extract information about workers. When users sign up for apps, they’re unaware that in exchange for using a free earned wage access app, they’re releasing personal information to third parties. Because data about pay, hours and overall financial health can be used to advertise to individuals, this data is valuable. The ability to track financial histories could make consumers more vulnerable to being targeted for other credit products they cannot afford.

Onus remains with the worker to request wages

While mobile apps are easy to use, employees still have to make a request for an advance. Today, it’s possible for faster payroll runs than the standard bi-weekly cycle, but EWA apps keep the responsibility of fast pay on workers.

Earned wage access alternatives

Technology can solve for the shortcomings of earned wage access, but businesses need to partner with the right solutions. Earned wage access alternatives, like daily payroll from Everee, offer the same on-demand pay features that attract workers to EWA in the first place.

Thanks to same-day ACH, it’s possible to run payroll fast—even daily—for W-2 employees and 1099 independent contractors. When employers invest in true fast pay solutions, workers can avoid fees, wait times and data concerns that prolong debt and financial instability.

Daily payroll

Workers can be paid everyday through a payroll system with same-day pay capabilities. Using the same-day ACH network, daily payroll allows for same-day deposits into any bank on the ACH network. Daily payroll works just like bi-weekly payroll, but payments are sent to workers every day instead of being held by the payroll provider for days or weeks at a time. As long as hours are confirmed by the proper admins, there’s no reason workers can’t get paid for the work the same day they performed it. Of course, it’s a matter of employers having payroll systems with fast pay capabilities.

Everee

While same-day pay is common today for 1099 contractors, solutions for W-2 workers are harder to find, due to complications with tax withholdings and wage calculations. Everee‘s payroll platform, however, supports same-day pay for both employees and independent contractors. Some industries like home services and on-demand delivery may run into cash flow issues if they were to run payroll everyday. That’s why Everee offers Everee Credit, a way for qualified employers to maintain cash flow while Everee makes daily payments to workers. These are not loans to employees—employers settle up after the regular pay cycle once they’ve received the funds they need.

Financial education benefits

There are a variety of apps that help workers, plan, budget and invest their personal finances without offering personal loans or charging for instant deposits. When workers have access to financial tools like budgeting software and investing education, they’re better equipped to make long-term financial decisions.

Employee assistance programs (EAPs)

EAPs are another way to provide workers with resources for financial wellness. EAPs offer counseling and other support services for a wide range of issues, including debt and financial stress. EAPs can be offered in-house or through contracted providers. It’s a popular program aimed at increasing engagement and reducing worker absenteeism; 79 percent of surveyed employers offered an EAP, according to the 2019 SHRM Employee Benefits research report.

Workers need fast pay

While employers across different industries need to fill more open jobs, EWA apps look like an attractive benefit for workers facing increased pressure on their earnings. But EWA is a band-aid to the need for fast and flexible pay.

EWA products attempt to address the lag between time worked and the traditional bi-weekly pay cycle, but hidden fees and 48-72 hour delays in deposits don’t actually help workers with an urgent financial emergency on their hands. Yes, EWA apps are increasingly popular, but they don’t solve the fundamental issues inherent in slow, traditional pay cycles.

After reviewing the pros and cons of earned wage access, it’s clear employees are still at risk for predatory debt cycles and financial instability even when they have access to an EWA app. If businesses are serious about offering employees a financial benefit without any strings attached, investing in faster payroll services is a healthier, less risky approach than encouraging EWA adoption.

Want to see how easy it is to run daily payroll? Check out Everee.