Paying employees may seem like a daunting process, especially when managing a new small business or fast-growing company; the complexities of paying employees and independent contractors (sometimes called 1099 employees) are usually beyond the average knowledge of a business owner.

However, determining how to pay employees isn’t as tricky as it looks. The secret lies in using the right tools to match your needs and choosing a payment process that best fits the classification of your workers.

This guide will cover:

- Laws regulating how to pay employees

- Types of employee compensation

- How to pay employees: payment methods

- Processing payroll to pay employees

- A note on how to pay independent contractors

Laws regulating how to pay employees

Paying employees is, by law, a mandatory responsibility of all business owners in the United States. The U.S. Department of Labor regulates worker pay in the U.S., and there are specific rules for how to pay independent contractors and W-2 employees. This guide will focus specifically on the rules regarding W-2 employees, but many of the same general principles apply to paying 1099 contractors, freelancers and gig workers.

The Fair Labor Standards Act (FLSA) is the main law governing how employers must pay their employees. The FLSA requires that most employees in the U.S. are paid at least the federal minimum wage and overtime for any hours worked over 40 in a week. There are some exceptions to these rules, such as for tipped employees and workers who are paid on a commission basis. To learn more about the specific regulations that apply to your business, review the details of the FLSA.

Types of employee compensation

There are 3 major types of compensation for employees: hourly wages, fixed annual salary and commissions.

Hourly wage

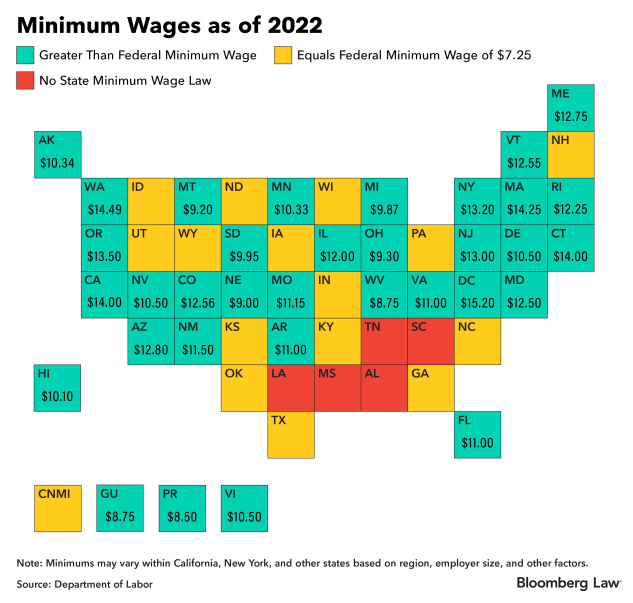

When an employee is paid an hourly wage, they receive payment in exchange for the number of hours they work during a specific pay period. In 2022, the Federal minimum wage in the United States is $7.25 per hour.

However, some states have their own minimum wage laws. When an employee is subject to both state and federal minimum wage laws, they are entitled to receive the higher of the two wages.

Source: Bloomberg Law

Minimum wage requirements can change year to year as states enact new laws. You can learn more about your state’s specific labor laws on the website of your state’s department of labor.

Hourly wage is most common for part-time or temporary employees. It’s also common for 1099 contractors. However, rates for 1099 workers are typically higher than minimum wage or the average hourly wage in a state. On average, employment taxes, including Medicare and Social Security, are approximately 15.3% of an employee’s gross wages. Companies withhold 7.65% from W-2 workers’ payments and pay the rest. 1099 workers, on the other hand, pay the full amount (15.3%) from their earnings. In addition, they pay quarterly estimated state and federal taxes. To make up for this contribution, 1099 workers usually command higher hourly rates.

Employees under hourly wage compensation can earn overtime if they provide services beyond the contract hours. According to the FLSA, employees must receive overtime pay at a rate of 1.5 times their regular hourly wage for all hours worked over 40 in a week.

Fixed salary

Salaried compensation involves paying your employees a fixed annual salary. This salary is typically paid in equal installments over the course of a year, regardless of the number of hours the employee actually works. This option is ideal if you’re in a corporate industry where your workers’ time input is foreseeable.

Salaried employees are typically exempt from overtime payments, but there are some exceptions. For example, administrative, executive and professional employees may be paid a salary and still receive overtime pay if they work more than 40 hours in a week.

Though not required by law in the U.S., salaried employees usually have benefits like health insurance and paid vacation days. These benefits are provided by the employer to encourage employee loyalty and attract new hires.

Salaried employees typically receive a W-2 form at the end of the year, which reports their wages and taxes withheld. This form is used when salaried employees file their taxes.

Commission

Commission pay is a type of wage that is earned when an employee sells goods or services. The payment is a percentage of the sales amount, and it’s usually paid to the employee after the sale has been completed. You can offer a commission to your employees in addition to a base pay rate whether it’s salaried or hourly.

As an employer, you must be careful when classifying employees as commission-based. If you misclassify an employee as commission-based when they should actually be hourly or salaried, you could face stiff penalties from the Department of Labor.

Commissioned employees are usually considered non-exempt under the FLSA, which means they are entitled to overtime pay for hours worked over 40 in a week. However, some retail and service commissioned workers are exempt from overtime pay.

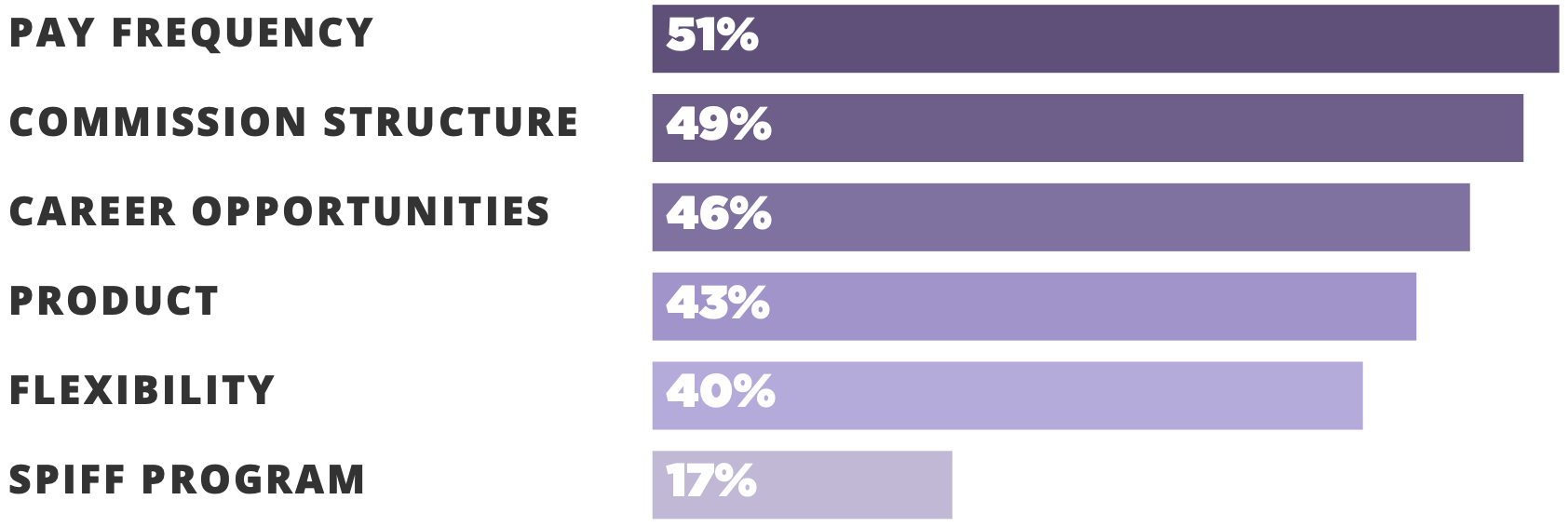

Commissions can be a great way to reward high-performing employees and is common in sales industries like real estate and insurance. However, a major downfall of commissions can be delayed payment. In some door-to-door industries like pest control or home security sales, sales reps are left waiting for commission payments months after closing a sale—and this can hurt retention.

In our 2021 survey of commission-based workers, respondents indicated that pay frequency was the most important factor in determining an employer.

Source: Everee 2021 Sales Pay & Performance Report

If you offer commission compensation, consider implementing payment tools that close the gap between a close sale and a commission payment.

How to pay employees: Payment Methods

Until recently, paying employees has been about paper checks and cash. With online payroll software, most workers receive bi-weekly payments directly into their checking account via Automated Clearing House (ACH) transfers. However, there are a growing number of flexible pay options available today for compensating workers, including daily payroll, mobile wallets, pay cards, earned wage access (EWA) apps and more. We’ll explore some of these options below.

Checks

Checks are known as the traditional way of paying employees. Employers write a check for the net amount due after all deductions are made, such as federal, state, and local taxes; Social Security and Medicare contributions; and insurance premiums. Using paper checks is a popular method among employers, especially for medium and small business owners with few employees.

Advantages of paper checks

Unlike other modes of payment involving electronic funds transfer, such as direct deposit, your employees don’t have to open a bank account in order to get paid. Instead, they can get cash via a check-cashing service. Additionally, you can distribute pay stubs to employees immediately.

Disadvantages of paper checks

Cutting paychecks every pay period is time-consuming, mainly when dealing with a large workforce. There’s also the possibility of misplacing checks, which becomes problematic for employer and employee alike.

Direct deposit

Direct deposit is an electronic funds transfer (EFT) that allows your employees’ paycheck to be deposited directly into their bank account. The program takes the hassle out of issuing and cashing checks and can save employers money on check printing and postage costs.

Employers initiate direct deposit payments by providing employee bank routing numbers and account numbers to the payroll processor. The funds are transferred electronically on a predetermined date.

Advantages of direct deposit

Direct deposit is a popular mode of payment, as it’s fast, efficient and secure. Employees don’t have to worry about lost or stolen checks, and employers can be assured that their employees’ paychecks will be deposited into their bank.

Disadvantages of direct deposit

Setting up direct deposit can be challenging and subject to human error. However, this is usually a one-time activity.

Pay cards

Want to go paperless? Pay cards, just like direct deposit, are viewed as an easy and efficient alternative to paying employees. Instead of sending money to a savings account via ACH, employers load a prepaid debit card with wages for a specific pay period.

Advantages of pay cards

Using pay cards eliminates the stress of printing checks and saves time that you can use in other essential duties. Moreover, your employees don’t need a bank account to access their wages.

Disadvantages of pay cards

Employees may have to pay some fees, including a monthly maintenance fee, if they have a pay card. Depending on your service provider, you might be required to clear the fees on their behalf. Additionally, you most likely will be offering other payment options like direct deposit. If you have W-2 workers and not just 1099s, a pay card can’t be the only payment method you offer since U.S. law requires W-2 workers have other ways to receive their money, like direct deposit.

Cash

The cash payment method involves handing over employee wages face-to-face. It doesn’t feature any technical process. If you decide to use this method, ensure that you remain extra careful when updating your accounting register.

Advantages of cash payments

A main advantage of using the cash payment option is incorporating employees who are not well versed in technology. And, of course, this option doesn’t require maintenance or withdrawal fees or spending on setup.

Disadvantages of cash payments

It’s challenging to manage and track your payroll record when you pay in cash, especially if you don’t update your accounting documents correctly. Additionally, the cash payment method is time-consuming when dealing with numerous employees.

Mobile Wallets

A mobile wallet is a virtual wallet that stores payment card information on a mobile device, such as a smartphone. With a proper business account, employers can use a mobile wallet to make payments to employees and other vendors.

Advantages of mobile wallets

Mobile wallets are convenient for employees because they can use their phones to make payments. They also reduce fraud since the transactions are encrypted. Generally, transferring money to your workers’ mobile wallet is a quick and streamlined process that benefits both employees and employers.

Disadvantages of mobile wallets

Using an app like Venmo for payroll is an auditing nightmare. Using apps like Paypal, Venmo and Zelle create problems for businesses because they are not meant for payroll. There is no way to restrict payments between employees, managers and the company. You also can’t batch payments, meaning that you would have to make a payment for every employee separately- a process that could take hours. If you’re going to go this route, make sure you have a third party like an accountant or bookkeeper who is familiar with the app and can help you navigate the murky waters of payroll taxes and mobile wallets.

Earned wage access apps

Earned wage access apps allow employees to access their wages after they’ve earned them, but before a typical payroll cycle. Through earned wage access tools, employees authorize their employer to deduct a set percentage of each paycheck and deposit it into a designated account when needed.

Advantages of earned wage access

EWA apps provide employees with a sense of control and predictability over their finances. They can also help employees avoid late fees or penalty charges on bills. EWA has become increasingly popular as employees demand faster pay, so an EWA program can help attract and retain employees.

Disadvantages of earned wage access

EWA programs can be expensive for employers. And it introduces yet another third-party vendor into the payment process that employers have to manage on top of their other payroll operations. Employees may also have to pay fees in order to access funds that are already there, which could be unpopular with your workforce. Because of this, earned wage access apps have been the focus of consumer protection debates due to hidden terms of service and predatory pricing targeting financial strapped employees.

When it comes to choosing a method of employee payment, there are a variety of things to consider. The most important factors are the preferences of your employees, maintaining compliance as a business and ease of use for you as the employer.

RELATED READING: What are real-time payments for workers?

Processing payroll to pay employees

Payroll processing entails everything relevant to compensating workers at the end of a pay period. This can be done manually if you choose, though it is a time-consuming and often error-prone process. You’ll need to keep track of hours worked, wages, taxes and other deductions to ensure that your employees are paid accurately and on time.

The entire process can be straightforward or a bit challenging, depending on the size of your company. Below are basic payroll processing steps:

1. Collect employees’ tax information

First things first, your current and new employees should fill out and submit necessary tax forms, including:

- I-9 form (for new employees)

- IRS W-4

- All other forms needed, such as documents for local withholding

An I-9 form is used to confirm the identity and employment eligibility of employees. The W-4 form is used to determine how much federal income tax should be withheld from an employee’s paycheck via allowances.

Additionally, if you opt to go with the direct deposit method of payment, you will also have to collect their banking details.

2. Determine pre-tax pay

Start by determining your payment schedule; it can be monthly, semi-monthly, weekly, or even daily. Then calculate the gross pay for every worker per pay period. For hourly workers, this is done by multiplying the hours worked by the hourly rate, and then adding any overtime pay, commissions or tips.

3. Calculate deductions

Deducting taxes is one of the most important aspects of payroll processing. The IRS requires that you withhold a certain percentage of an employee’s wages for federal income tax, Social Security and Medicare. You’ll also need to deduct state and local taxes, as well as any other required payments, such as 401(k) contributions.

4. Determine net pay

At this point, you have already calculated the gross pay and total withholdings. Next, you will determine every employee’s net pay by subtracting their total withholdings from the gross pay. This will give you the amount that needs to be paid to your employees.

For instance, for an employee whose gross pay and amount to be withheld are $4,000 and $500, respectively, the worker’s net pay will be $3,500.

5. Distribute the net pay to your employees

You can use different types of employee payment methods we’ve reviewed above to distribute wages. Many businesses work with a payroll company or use a payroll software to simplify the payment process. You will eliminate paperwork and spend the time saved on other crucial tasks.

6. Pay payroll taxes

Employers are responsible for submitting a report and paying any taxes withheld from employee checks as well as your part of any taxes, if applicable. Typically, you should file taxes with your local government tax collection agency and the IRS. Remember, this applies to W-2 employees only.

7. Pay into benefits

A percentage of the amount you withhold may be spent on employee benefits, like retirement, health insurance, health savings account, flexible spending accounts, and commuter benefits. You should make these payments on behalf of your employees.

8. Keep accurate payroll records

Ensure that you maintain accurate, organized, and up-to-date payroll records. Add details about the employees paid, the amount of work they did, and the money you paid them. You will need this information in the future in case of an audit by the IRS.

A note on paying independent contractors

While paying 1099 workers is different from W-2 employees, the process is simple—especially if you already have an established payroll system. The best way to pay independent contractors is to have a payroll software designed to pay 1099 workers in addition to W-2 employees. If you aren’t sure whether a worker is an independent contractor or employee, you can seek legal advice on worker classification.

RELATED READING: Payroll for independent contractors explained

Paying employees should be easy

Paying employees is a necessary business function, and it’s obvious many things need to be taken into account when compensating workers. However, it doesn’t need to distract you from the most important things like growing your workforce and onboarding new hires.

The payroll process can be straightforward and successful with adequate knowledge and the right tools. Modern, automated payroll software like Everee and services make the process easy, so you can focus on what you’re good at: running your business.