As the gig business model continues to thrive, more and more workers in the United States are becoming independent contractors. And some believe it’s only a matter of time before we see a 50-50 split between W2 employees and 1099 contractors. While contractors provide several benefits to organizations—including flexibility and cost-effectiveness—managing a slew of 1099 workers isn’t without its challenges. Chief among them? Figuring out payroll for independent contractors that ensures fast, efficient and reliable payment.

Payroll for contractors

When organizations consider how to pay independent contractors, they often turn to band-aid payment solutions like Venmo and PayPal. Suffice it to say that this is an annoying, error-prone process that takes a lot of time.

Seeking a better way forward, an increasing number of organizations are investing in purpose-built contractor payroll solutions that enable them to pay contractors from the same familiar platform they use to pay their full-time employees.

Keep reading to learn more about how independent contractor payroll works, the differences between paying employees and paying contractors, and how the best way to pay independent contractors can help you ensure all of your workers are paid accurately and quickly, week in and week out.

How does independent contractor payroll work?

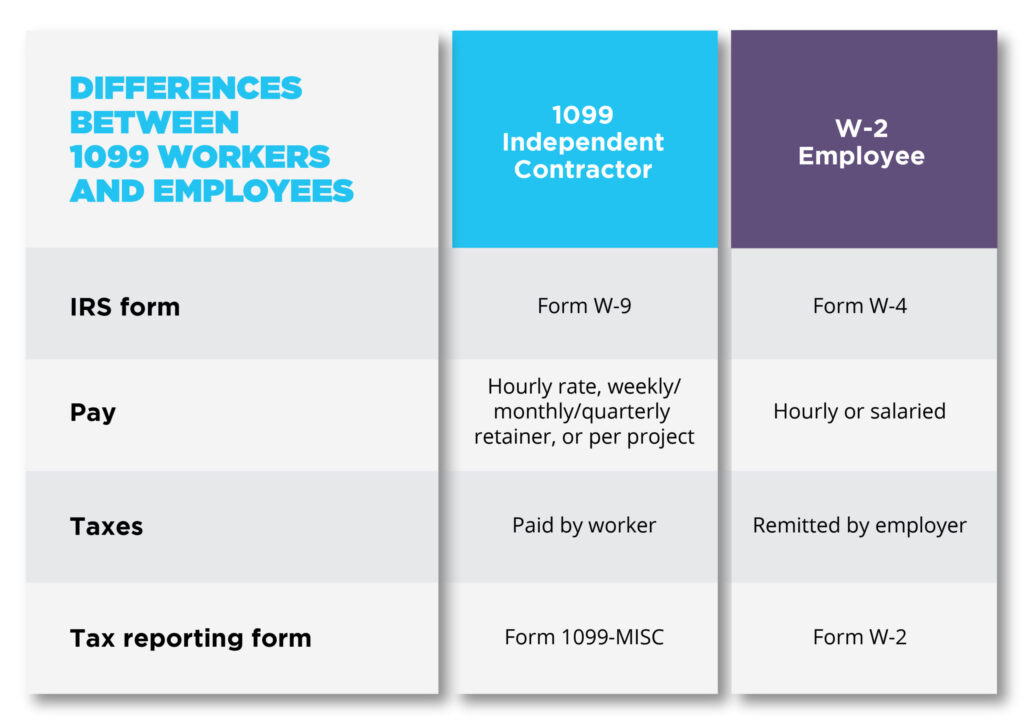

Though there are some differences, independent contractor payroll is essentially the same as employee payroll. You need to figure out how much you’re going to pay the contractor, how frequently you’ll pay them, and the method that you’ll use to facilitate the payments. In some ways, independent contractor payroll is even easier than regular payroll because you don’t have to take out any taxes, insurance premiums or 401k deductions from every paycheck.

Of course, there are stipulations surrounding which workers qualify as employees and which qualify as contractors. Generally speaking, the IRS classifies gig workers as contractors when they’re able to choose where and when to work and use their own tools instead of equipment given to them by a company. Many states use the ABC test to correctly determine classification for workers.

Once classification is determined, there are a few different areas you need to get in order before running contractor payroll.

Setting contractor rates

First and foremost, you need to figure out how much you’re going to pay your contractors. Depending on the nature of your business, you might set rates and see if any 1099 workers bite—similar to how companies like Uber and DoorDash operate. On the other hand, you might want to work with skilled contractors who set their own rates—which could be hourly or per-project fees, monthly retainers, or commission-based structures.

Pay runs

After you’ve ironed out rates, it’s time to figure out how frequently you’re going to pay contractors. Historically, contractors have issued invoices at the end or beginning of the month or the end or beginning of a quarter. In recent years, this has changed, with companies paying contractors much more frequently: biweekly, weekly, and—in some cases—even daily. On-demand pay solutions are also becoming more popular. We’ll talk more about how you can run daily payroll for independent contractors below.

Payment type

Now that you know how much you’re going to pay contractors and how often, you need to determine the payment mechanism you’re going to use. While some companies pay contractors via ACH direct deposits so that money shows up in their bank accounts, others might issue checks and send them through the mail.

Of course, there are also peer-to-peer solutions (e.g. Venmo, CashApp, Zelle and others). While these apps can certainly be used to facilitate payments to contractors, they leave much to be desired, particularly at scale, due to the time-exhaustive nature of the process and lack of visibility into payment data.

Independent contractor IRS forms

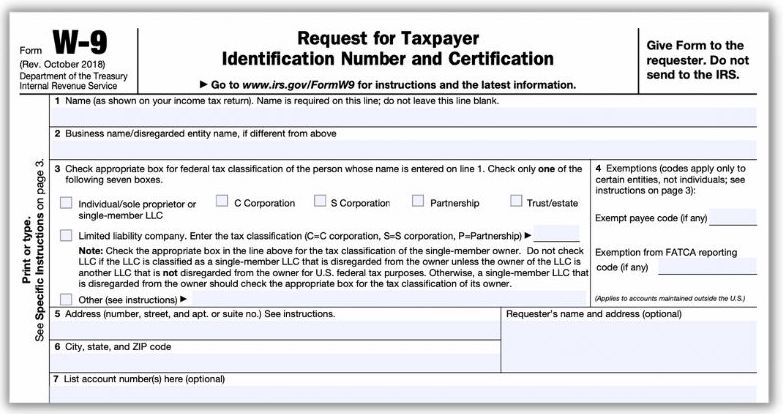

When you set up independent contractors in a payroll system, you need your workers to fill out Form W-9—not Form W-2, which regular employees fill out. Depending on your onboarding system, you or your workers will need to confirm their personal information like name, banking details, etc. In some contractor payroll platforms, workers can be added in a bulk upload to save time.

Now that you have a better idea of what you need to start running payroll for independent contractors, let’s take a look at some of the differences between paying W2 employees and paying 1099 contractors.

What are the differences between payroll for employees and payroll for contractors?

With the right payment platform in place, there isn’t much difference between paying employees and paying contractors. Your administrator runs payroll, money is sent out, and everyone’s happy.

That said, there are some important nuances to independent contractor payroll that administrators and business leaders need to be aware of.

1. No withholding of taxes

From an employer’s perspective, one of the biggest benefits of hiring contractors is the fact that you don’t have to cover their payroll taxes. While all U.S. workers are required to pay 15.3 percent of taxes on up to $142,800 in wages, companies typically pay half of that amount on behalf of employees, with the other half usually being withheld from employees’ paychecks. Contractors, on the other hand, need to pay their entire payroll tax obligation out of their own pockets.

In some ways, it’s actually easier to pay contractors because you don’t have to worry about tax withholdings, which means there’s less work involved.

Unfortunately, not every payroll platform supports 1099 classifications—making it all the more important to seek out a solution that does if you have a lot of contractors on the books or are planning to add more in the future.

2. Contractors don’t have benefits

Since contractors are responsible for their own benefits—things like health insurance and dental insurance—payroll administrators don’t have to worry about deducting any premiums from their checks. Similarly, contractors are responsible for their own retirement savings, giving payroll admins one less thing to think about.

Once again, this makes the contractor payroll process a bit easier. If a contractor makes $20 an hour and works for 22 hours in a week, the company owes them $440 for that work. It doesn’t get more straightforward than that.

3. Predictability of payments and associated implications

Most full-time employees have the luxury of knowing exactly when they’re going to get paid and, if they’re salaried, exactly how much they can expect to get paid. Most commonly, employees are paid once a week, every other week, or on the 15th and 30th of the month. And for the most part, they have a decent idea of how much they’ll take home with each check — if not the exact amount every time.

Contractors, on the other hand, can never really be certain about how much they’ll get paid each month. In most cases, they also have no idea when they can expect payment. After all, most organizations aren’t able to pay employees and contractors through the same payroll platform, which increases the chances payments to contractors are delayed.

Since 16 million contractors live paycheck to paycheck and predatory payday loans are increasingly popular with workers, it’s critical that organizations do everything in their power to pay their gig workers quickly and accurately. Otherwise, there’s a good chance they’ll have to manage higher-than-desired contractor turnover rates — something that few companies can afford as they try to combat widespread labor shortages.

Can an independent contractor be put on payroll?

The easiest way to ensure contractors are paid in a timely, accurate manner every time is by putting them on the same payroll platform you use to pay your W2 employees. By doing so, payroll administrators can make sure that contractors are paid when employees are.

Even better, organizations can embrace flexible pay solutions that enable them to pay contractors quickly — even as fast as the same day they work. Since 84 percent of gig workers are interested in getting paid quicker than they are, this is a no-brainer for companies that plan on working with a lot of 1099 contractors for the foreseeable future.

Since not all payment platforms are the same, it’s critical to do your due diligence and make sure you pick the right solution for your needs. In the next section, we’ll examine what to look for in a payroll solution.

What you need in a payroll software for contractors and gig workers

At the end of the day, the right payroll system will make life easier for your accounting staff while ensuring the people your business relies on are paid quickly and accurately for their hard work.

As you begin searching for the solution that’s right for your organization, look for a contractor payroll that offers:

- Support for both W2 and 1099 workers so that you can pay both employees and contractors easily while maintaining compliance

- Flexible pay for contractors to give them the ability to access the money they’ve earned when they need it, without having to take out payday loans or absorb the fees in earned wage access apps

- Daily pay deposits listed in job descriptions can attract workers in a labor shortage, and the right payroll platform makes it easy

- Credit for improved cash flow means you can run payroll daily without placing a crunch on your cash management

- Intuitive design and easy onboarding ensures all workers, including your operations team and your gig workers, can find their way around the payroll system with little effort

- Integrations with other HR systems helps your payroll team maintain a single source of truth from one place instead of hopping from one platform to the next to do their jobs

If you’re searching for a new independent contract payroll solution, why not look for a complete platform that lets you pay all of your workers from one place? Companies like Dlivrd, Tend and Fusion Staffing turn to Everee to pay their independent contractors. For more information on the easiest way to pay workers daily with less work, check out Everee.